The Definitive Guide for Stages Of Team Development – Hawaii Doe

The Only Guide to Strengths Perspective On 5 Stages Of Group Development

: The auto mechanics of intergroup interaction, decision-making, as well as responsibility are concurred upon and handled successfully. Nearly all groups do not have several of these standards eventually in their period. Team development makes every effort to fulfill these requirements with continuous reflection and also growth. Like any kind of advancement, it takes time as well as commitment to be reliable.

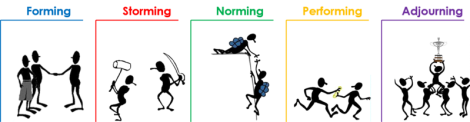

As the genuine work begins, the job may provide both technological as well as social challenges. Individual job habits, leadership decisions, or lapses in communication can cause tension within a group. Aggravation, aggravation, and also stress and anxiety frequently arise in reaction. This phase of team development is called storming. Storming is the most tough and also ineffective of the five stages of advancement, however it is however important to the team development procedure.

With this info, the team can start striving to a better team dynamic. The norming stage of team development is the calm after the tornado. In this phase of team development, staff member come under a rhythm as a natural taskforce. The abilities of each participant are verified and utilized to perform the needed jobs.

Get This Report on Usa Hockey National Team Development Program

The team can handle conflict and also wage the job efficiently. Some teams get to a stage of growth in which they flourish at their specific as well as collective tasks. The abilities of each member are totally maximized, supervision is practically never needed, and also participants really feel a strong feeling of count on one an additional.

Getting to the carrying out stage is a major success and commonly speeds up some type of team discovering. Group discovering is a behavior procedure of looking for, event, discussing, and carrying out techniques of team success. Whether through training, team campaign, or innovative leadership, team understanding is an action step that makes sure healthy team development.

Learning Outcomes Define the 5 stages of team development. Explain just how group norms and also cohesiveness influence efficiency. Intro Our conversation thus far has focused mostly on a team as an entity, not on the individuals inside the team. This resembles describing an automobile by its version as well as shade without considering what is under the hood.

A Biased View of What Is An Agile Development Team??

In teams, the inner characteristics are the people in the team as well as how they engage with each various other. For teams to be efficient, the individuals in the group should be able to function together to add jointly to group outcomes. This does not occur automatically: it creates as the group works with each other.

Phases of Team Development This procedure of discovering to collaborate successfully is understood as team development. Research has actually shown that teams go through clear-cut stages during development. Bruce Tuckman, an instructional psychologist, determined a five-stage growth procedure that most teams follow to become high executing. He called the stages: forming, storming, norming, doing, and also adjourning. employee engagement.

The majority of high-performing teams go through 5 phases of team development. Creating phase The creating stage entails a period of positioning as well as getting familiarized. Unpredictability is high during this phase, as well as people are seeking leadership and authority. improve employee retention. A member who asserts authority or is knowledgeable may be aimed to take control.

The Best Strategy To Use For Rural Trauma Team Development Course – Acs – The …?

Team performance enhances throughout this phase as participants discover to coordinate as well as begin to concentrate on group objectives. The consistency is precarious, and also if differences reappear the group can slide back right into storming. In the carrying out stage, agreement as well as teamwork have been well-established and also the group is fully grown, arranged, and well-functioning.

You will rethink your approach to teamwork with this model

Issues and disputes still arise, but they are dealt with constructively. (We will discuss the role of conflict and also dispute resolution in the following area). The group is concentrated on issue resolving as well as meeting team objectives. In the adjourning stage, a lot of the group`s goals have been accomplished. The emphasis is on concluding last jobs and recording the initiative as well as outcomes.

There might be regret as the team ends, so a ritualistic recognition of the job and success of the team can be helpful. If the team is a standing committee with recurring responsibility, members might be changed by brand-new individuals as well as the group can go back to a developing or storming stage and repeat the growth procedure.

Examine This Report about 8. Progress Through The Stages Of Team Development

Group norms established a standard for actions, perspective, and also performance that all staff member are anticipated to adhere to. Standards resemble policies however they are not listed. Instead, all the team members implicitly comprehend them. Standards are efficient because staff member want to sustain the team and protect relationships in the team, and when norms are breached, there is peer stress or permissions to implement conformity.

During the creating as well as storming phases, norms concentrate on expectations for presence as well as commitment. Later on, during the norming and executing phases, norms focus on connections and degrees of efficiency. Performance norms are really crucial because they define the degree of job effort and also criteria that figure out the success of the group.

Norms are just effective in controlling behaviors when they are approved by staff member. The degree of on the group mainly figures out whether group participants approve as well as adapt norms. Team cohesiveness is the extent that members are drawn in to the team and are inspired to continue to be in the group. improve employee retention.

9 Easy Facts About How To Build A Successful Team – Business Guides – The New … Described

They try to comply with standards because they want to keep their relationships in the group and they intend to fulfill group expectations. Teams with solid performance norms and also high cohesiveness are high carrying out. The seven-member executive team at Whole Foods spends time together outside of work. Its participants regularly interact socially as well as also take team vacations.

You don`t have to get superpowers from a lotion or produce one of the most famous brand names of your generation to be a wonderful leader. Overview your team through each phase of the process with the complying with ideas:1. Establish a clear function as well as goal and also revisit it throughout the procedure.

It is the structure that will assist you choose. It offers you instructions. Without it, you`ll go nowhere. People get so shed in a particular job that they forget why they are doing it to begin with. It is very easy to forget the “huge picture”. Teams require a clear objective and objective and ought to be reminded of them typically.

The Only Guide for Strengths Perspective On 5 Stages Of Group Development

Establish guideline and make certain they are followed. Rules might not seem fun, but they clear up complication. Without them, no one will certainly recognize what is thought about appropriate habits. Every person will have their own “style” of doing things. Groups without guidelines are disjointed, vulnerable to problem and also inefficient. One of the first jobs that teams should do is establish ground regulations.

Some instances are:More info here Don`t disturb an additional participant when they are talking. Shut off your phone throughout working meetings. Track your time transparently with Toggl Track. Create a regular work strategy with tasks and also share it with the team. Remember that guidelines are produced to assist your team remain concentrated on what issues mostperformance.

Turnkey team development programs

Allow other participants serve as leaders or facilitators. Every team needs to have a facilitatora person that leads and overviews conferences and discussions. A person who drives the team towards an usual objective. As a company creator or supervisor, you may be the marked team leader. That doess not indicate you must always be the one leading.